Property Revaluations to be completed by October

The revaluation program of all property within the Borough of Fanwood is proceeding smoothly and as expected. The intended efforts of this revaluation will reflect the changes in market values that have occurred in the Borough since the last revaluation of Fanwood, conducted over 30 years ago in 1983.

New Jersey State law mandates that all real estate be assessed at current market value. Market value is defined as the price a property would sell for on the open market between a willing buyer and seller. The Borough was ordered to conduct the revaluation program by the Union County Board of Taxation and began the program in May.

Since then, Realty Appraisal Company, of West New York, New Jersey, has deployed a crew of property inspectors throughout town, measuring and inspecting dwellings and commercial buildings. As of early September, Realty Appraisal Company has confirmed that approximately 90 percent of the dwellings have been visited, and the inspection process is slated for completion by October.

The project supervisors, Steven and Neil Rubenstein, in consultation with the Borough Tax Assessor, Michael Ross, are currently analyzing recent sales and listings in order to accurately assess and estimate the market value of all Borough properties.

At the conclusion of this revaluation, each property owner will receive a notice of their property’s new valuation, as determined by Realty Appraisal Company. Please be aware, the notification letter will contain a phone number and web address that property owners can use to schedule an appointment in Fanwood for an informal review of their valuation, if they so desire. We anticipate mailing those letters in mid November. We anticipate meeting with property owners will begin in early December.

Fanwood Property Revaluation Program

The Borough is responding to an order from the Union County Board of Taxation to conduct a revaluation of all residential and commercial properties. Fanwood is one of 14 Union County towns, and 32 towns in New Jersey, that were identified as in need of updated property valuations. The last revaluation in Fanwood was done 32 years ago. Tax Maps have been approved by the state of New Jersey and the revaluation process is expected to commence in May 2019

Mayor Colleen Mahr and the Fanwood Borough Council hosted a community meeting in April 2019 to answer residents’ questions about the revaluation process. We appreciated the great turnout and the many good questions we were able to address. Here’s the video of that meeting.

Fanwood Property Revaluation Program FAQ

The Borough is responding to an order from the Union County Board of Taxation to conduct a revaluation of all residential and commercial properties. Fanwood is one of 14 Union County towns, and 32 towns in NJ, that were identified as in need of updated property valuations. The last revaluation in Fanwood was done 32 years ago.

A revaluation is undertaken by a municipality to appraise all real property within a town to determine its full and fair value and more in line with market values. That value is the price at which the tax assessor believes is a fair and bona fide sale price of a property.

The validity of the market value estimate depends on the collection of accurate data.

A revaluation program, which is supposed to be done periodically, seeks to more accurately reflect market conditions and spread the tax responsibility equitably within a municipality. Since market conditions change and assessments rarely change over time, the relationship between assessments and market values become more distant and must be brought into line.

Real property must be assessed at the same standard of value to ensure that every property owner is paying a fair share of the property tax.

For example, if the market value of your home is $300,000, it should be assessed at $300,000; if you have a market value of $600,000, your home should be assessed at $600,000.

Typically, a revaluation will result in an increase of property assessment (value), but it does not mean that all property taxes will increase.

A common misconception is that a Revaluation is done just to increase property taxes. Property taxes are determined by the municipal, county and local school district budgets. If these budgets increase but state aid does not, local property taxes will go up.

It is important to remember that assessments are merely a base used to apportion the tax responsibility. The tax level is the amount that the municipality must raise to fund the operation and services of county and local government and support the school system.

The interior and exterior of each property is typically inspected. For example, inspectors will record number of bathrooms, verify measurements, interior finishes, age of property.

In short, all information believed to influence value is reviewed and analyzed to make a proper determination of each property’s full and fair value.

In addition, recent sales of properties are studied and possibly adjusted to estimate the value of property that has not been sold. Property purchased for investment purposes is analyzed for its income-producing capability.

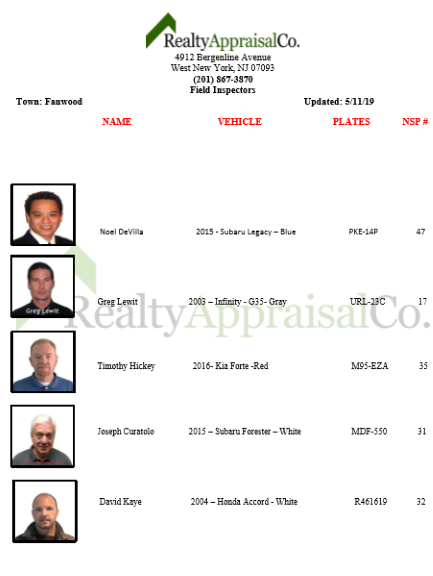

The Borough has hired Realty Appraisal Company to perform this service. The representatives doing the actual inspections and collecting information are not necessarily responsible for developing the market value estimate. Click here to see who the individuals inspecting your home will be.

Yes. The revaluation firm is required to notify each taxpayer by mail advising of the new appraised value prior to the new value being officially posted on the tax list.

The notice of your new assessment will include information about how to request a personal informal hearing to review your proposed assessment.

The revaluation process will start in May 2019. New Tax Maps for the Borough are currently being reviewed by the State of NJ. Once approved, the revaluation of properties will begin. The new assessments must be completed by October 1, 2019 and in place for the 2020 Tax Levy. Click here to learn more.

You can pick up a brochure from Realty Appraisal Company, the firm conducting the revaluation program, at Fanwood Town Hall and the Fanwood Public Library. You can also click on this link for more information about the process and the firm conducting the revaluation: www.realtyappraisal.net/homeowner-faq

Revaluation Overview

A revaluation is undertaken by a municipality to appraise all real property within a town to determine its full and fair value and more in line with market values. That value is the price at which the tax assessor believes is a fair and bona fide sale price of a property.

The validity of the market value estimate depends on the collection of accurate data.

Understanding Property Inspections

You can pick up a brochure from Realty Appraisal Company, the firm conducting the revaluation program, at Fanwood Town Hall and the Fanwood Public Library. You can also click on this link for more information about the process and the firm conducting the revaluation: www.realtyappraisal.net/homeowner-faq

Fanwood Field Inspectors I.D.

Property inspectors from Realty Appraisal Company are currently making their way through Fanwood neighborhoods to conduct property inspections. The interior and exterior of each property is typically inspected. For example, inspectors will record number of bathrooms, verify measurements, interior finishes, and the age of the property.

We encourage all residents to cooperate by providing access to inspectors so that accurate information regarding the condition of your home can be relayed to the appraiser. You can review the list of inspectors here to verify their identity.